Description from FED! What Does the Support Plan Cover?

WASHINGTON (AP) — The Federal Reserve is taking additional steps to provide up to $2.3 trillion in loans to support the economy. The money will target American households and businesses, as well as local governments besieged by the coronavirus outbreak.

The Fed said Thursday that it is activating a Main Street Business Lending Program authorized by the CARES Act, the largest economic relief package ever passed by Congress.

ALSO!

Federal Reserve Chairman Jerome Powell said the Fed’s role was to “provide as much relief and stability as we can during this period of constrained economic activity.”

When President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, into law, he initiated a $2 trillion stimulus package, the largest emergency relief bill in American history.

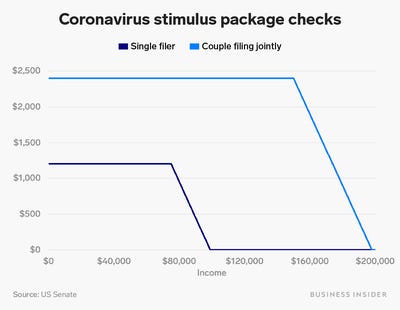

Part of that package is one-time cash payments of up to $1,200 to Americans who qualify.

An extra $1,200 is always welcome. But with the announcement of the cash came the questions: What is it? Who gets it? How much will I get? Is it taxable? What do I have to do to get it?

Below, we’ve answered those questions and more. Read on for everything you need to know about your coronavirus stimulus check.

Am I going to get a check?

You will get a check if you:

- Have a Social Security number.

- Have filed taxes in 2018 or 2023, or don’t earn enough to file but receive Social Security payments.

- Earned less than $99,000 for single filers, $136,500 for heads of household, or $198,000 for married filers according to the most recent tax return filed.

- Are not claimed by someone else as a dependent.

If I get a check, will it affect my tax refund?

No. Even though the stimulus payment may feel and look like a tax refund, it’s not. You’ll still get your full tax refund next year (and this year too, for that matter), as long as you file a tax return.

The stimulus check is a tax credit, which reduces your tax bill on a dollar-for-dollar basis. It’s like having store credit at your favorite clothing shop — when you apply it to your total bill, it reduces what you owe.

You usually can’t claim a tax credit until you file your taxes since you don’t know what you owe until the year is over. Because of the severity of this national crisis, the government is giving qualifying taxpayers their credit early in the form of a cash payment. It will not affect your refund this year or next.

How much will I get?

The IRS bases the amount of your payment on the adjusted gross income (AGI) listed on your most recent tax return: 2018 or 2023.

The maximum payment is $1,200 for single filers with an AGI below $75,000 or single parents (heads of household) with an AGI below $112,500. Married couples who file jointly and have an AGI below $150,000 will get a total of $2,400.

Payments will begin to phase out at a rate of $5 for each $100 over the AGI threshold before ceasing at an AGI of $99,000 for single filers, $136,500 for heads of household, and $198,000 for married filers. There’s also an additional $500 allotted to parents who have an AGI within the phaseout range for each child younger than 17.

You can use an online calculator to figure out how much your check will be if you’re unsure.(Illinois)

Do I need to do anything to get a stimulus check?

You do not have to sign up to receive a stimulus check. The process is automatic for most Americans who qualify.(Illinois)

If you file taxes:

To get a check, you must have a Social Security number (nonresident aliens, people without a Social Security number, and adult dependents are not eligible). If you filed taxes in 2018 or 2023, that tax return must reflect an adjusted gross income below $99,000 for single filers, $136,500 for heads of household, and $198,000 for married filers.

Note that if you’ve moved, and you haven’t provided the IRS with direct-deposit information, you should make sure the agency has the correct address on file to receive a paper check in the mail.

If you file taxes but don’t usually get a tax refund, and therefore haven’t given the IRS your direct-deposit information, you might have to wait several weeks or months to get paid. The IRS says it is developing a “web-based portal” to collect bank details from people in this situation for quicker payment, but for now, you can expect to get a paper check in the mail.

If you don’t file taxes:

If you don’t file taxes but do get Social Security payments, the government will use that information for your payment.

If you don’t file taxes or get Social Security payments, the IRS has announced it will set up a “web-based portal” for you to submit your information (more to come on the details of that).

TurboTax has also launched a free web portal for people who don’t file taxes to submit direct-deposit information to the IRS, although a PR representative for TurboTax confirmed to Business Insider that its stimulus registration webpage is not the web portal to which the Treasury had previously alluded.

Who won’t get a stimulus check?

Dependents older than 16, people without a Social Security number, and those with incomes above $99,000 (or $136,500 if you file as a head of household) won’t get a stimulus check.

How will I get the money?

Most people will get the money deposited directly into their bank accounts.

People who do not set up direct deposits with the federal government will be mailed a paper check.

People who don’t file taxes but do get Social Security payments will get a payment the same way they get their Social Security payments.

People who don’t file taxes or get Social Security payments will need to send the IRS their information through a “simple web portal” (more details to come). They may also use TurboTax’s free web portal to submit direct-deposit information to the IRS.

When will I get my stimulus check?

“If we if have your information, you’ll get it within two weeks,” Treasury Secretary Steven Mnuchin said in a White House press briefing, according to The Washington Post. “Social Security, you’ll get it very quickly after that. If we don’t have your information, you’ll have a simple web portal. We’ll upload it. If we don’t have that, we’ll send you checks in the mail.”

For taxpayers who can use direct deposit, the payment should be deposited mid-April.

However, NBC News reported that for Americans who haven’t set up direct deposits with the federal government, it could take much longer: up to five months for about 60 million Americans to receive a paper check.

Business Insider’s Bryan Pietsch wrote: “In early May, the IRS will send out paper checks to those without direct deposit, and it could take around 20 weeks to issue all of the checks, the report said. Those with lower incomes will reportedly be prioritized, and those on Social Security will receive their payments as they would their Social Security checks.”

How does the IRS know where to send the money?

In most cases, the IRS will take direct-deposit information or a mailing address from your most recent tax filing. For people who receive Social Security payments but don’t have enough income to file taxes, the IRS will use the information from the Social Security payments.

If neither of the above situations applies to you, but you qualify for a payment, the IRS has said it will set up a “simple tax return” in an online portal, through which you’ll be able to give the IRS your contact details. More information is coming on this feature. Those who want to submit direct-deposit information to the IRS may also use TurboTax’s free web portal.

What if my 2018 income qualifies, but my 2023 income doesn’t?

The IRS bases the amount of your payment on the AGI listed in your most recent tax return: 2018 or 2023. In some cases, when your income changed between 2018 and 2023, your 2018 income might qualify for a larger payment than your 2023 payment, or perhaps it might qualify for any payment while your 2023 does not.

In that case, because the IRS has extended the federal tax filing and payment deadline to July 15 (all states that tax income have also their deadlines, in most cases until July 15), you could hold off filing your 2023 income taxes until after the IRS has issued your payment, forcing the organization to use your 2018 income for your payment.

Waiting to file has a few downsides, like waiting longer to get your refund and giving identity thieves more time to try to prey on your taxes. But Riley Adams, a public accountant, previously told Business Insider if you’d qualify for a stimulus check under your 2018 income but not at all under 2023, it might be worth holding off filing for a few weeks (assuming you haven’t already).(Illinois)

What if I owe back taxes right now?

These payments are treated differently than your tax refund. Typically, you can have your refund seized if you owe back taxes, but that’s not the case here. Even people with tax debt should be getting a stimulus payment if they’re under the income thresholds. The only people who could get their check reduced because of debt are parents with outstanding child support.(Illinois)

I got a phone call, email, or Facebook message about my check. Should I answer?

No. The US government isn’t calling, emailing, Facebook-messaging, or otherwise contacting you about your stimulus check — and if someone does, it’s probably a scam.

The IRS generally gets in contact with taxpayers through snail mail, and in the case of stimulus checks, it doesn’t need to contact you for any type of additional information. The process is automatic for any American who qualifies. If someone is calling or emailing you to confirm personal details or asking for bank information or money, it’s a scam.

Unfortunately, scammers are taking advantage of this opportunity to steal people’s identities, money, or both. These scams include fake stimulus checks that arrive immediately with an unusual denomination and ask you to verify the receipt online, as well as someone claiming that paying a “processing fee” will get your money to you sooner.

What if I get my check and it’s too big?

Technically, this payment is a tax credit. A tax credit reduces your tax bill on a dollar-for-dollar basis. It is one of the last steps in calculating your annual tax liability and can be claimed regardless of whether you itemize your deductions. Some tax credits, like the coronavirus recovery rebate, are refundable. That means you’ll still get the money even if you don’t have enough tax liability to offset it.

There aren’t any clawback provisions outlined in the law, so you wouldn’t be expected to repay any of the money if you wind up getting too much.

What if I get my check and it’s too small?

While it won’t help you today, experts say the IRS will allow taxpayers to reconcile underpayment on next year’s tax return.

“If you should have gotten a check and didn’t, or if you should have gotten more than you did because the IRS didn’t know something important (like you have a kid), you should get more money” next tax season, Kelly Phillips Erb, a tax lawyer, wrote for Forbes.

Correction: This article has been updated to correct the age for which an additional $500 is allotted to parents: That payment is for those who have an AGI within the phaseout range for each child younger than 17, not 16.